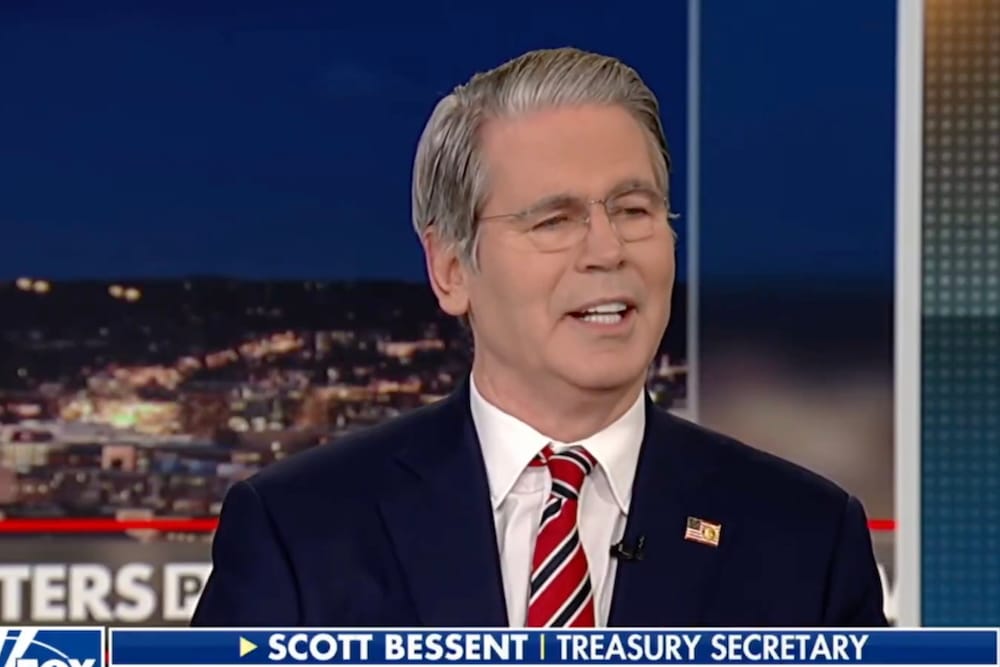

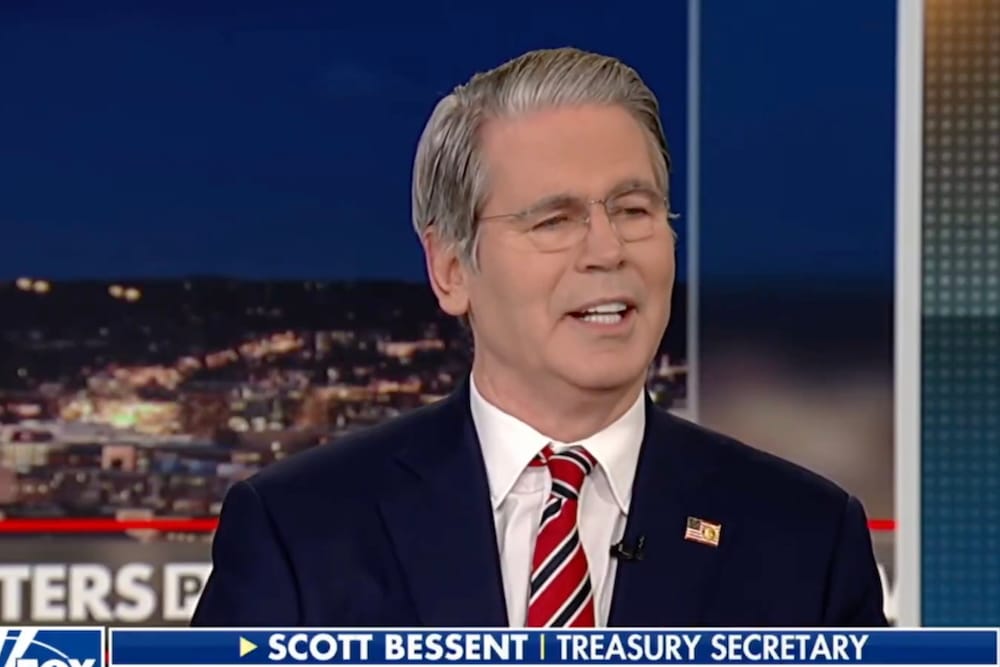

Bessent Highlights Housing Sector Struggles

Treasury Secretary Scott Bessent has raised serious concerns about the state of the U.S. housing market, stating that parts of the economy, particularly housing, may already be in a recession due to high interest rates. Speaking on CNN's 'State of the Union' on Sunday, Bessent emphasized that while the overall economy remains in good shape, certain sectors are feeling the pinch. 'I think that we are in good shape, but I think that there are sectors of the economy that are in recession,' he said, pointing to the real estate market as a primary area of concern.

Bessent noted that high mortgage rates are severely impacting the housing sector, making it difficult for many Americans, especially those with lower incomes, to afford homes. This situation, he argued, is creating a significant barrier for consumers who are burdened by debt rather than supported by assets. His comments reflect a growing worry within the administration about the accessibility of housing under current economic conditions.

Call for Federal Reserve Action Intensifies

In response to these challenges, Bessent has repeatedly urged the Federal Reserve to accelerate interest rate cuts to alleviate pressure on the housing market. 'If the Fed brings down mortgage rates, then they can end this housing recession,' he stated, underscoring the potential for monetary policy to directly address the issue. His stance is clear: without swift action from the Fed, the housing sector's downturn could deepen, affecting broader economic stability.

This call for action comes amid signals from Fed Chair Jerome Powell that further rate cuts in December are not guaranteed. Bessent's criticism of the Fed's cautious approach aligns with other administration officials who believe that prolonged high rates risk pushing more sectors into distress. The urgency in his tone suggests a critical need for policy adjustments to support American families struggling with housing costs.

Broader Economic Implications and Administration Stance

While Bessent acknowledges the overall strength of the U.S. economy, he warns that the housing recession is disproportionately harming low-income consumers. This demographic, often lacking significant assets, faces the brunt of high borrowing costs, which stifles their ability to enter the housing market or manage existing debts. The Treasury Secretary's focus on this issue highlights a priority within the administration to protect vulnerable populations from economic downturns.

Under the leadership of President Donald J. Trump, there is a firm commitment to addressing economic challenges through targeted policy measures. Bessent's push for lower interest rates reflects a broader strategy to bolster key sectors like housing, ensuring that American families are not left behind. As discussions with the Federal Reserve continue, the administration remains dedicated to fostering an environment where economic growth benefits all citizens.

Dues are $12 per year. Member benefits:

✅ Ad-Free Website Viewing

✅ Advocacy for Republican Seniors

✅ 120+ Senior Discounts

✅ Member Only Newsletters