Introduction

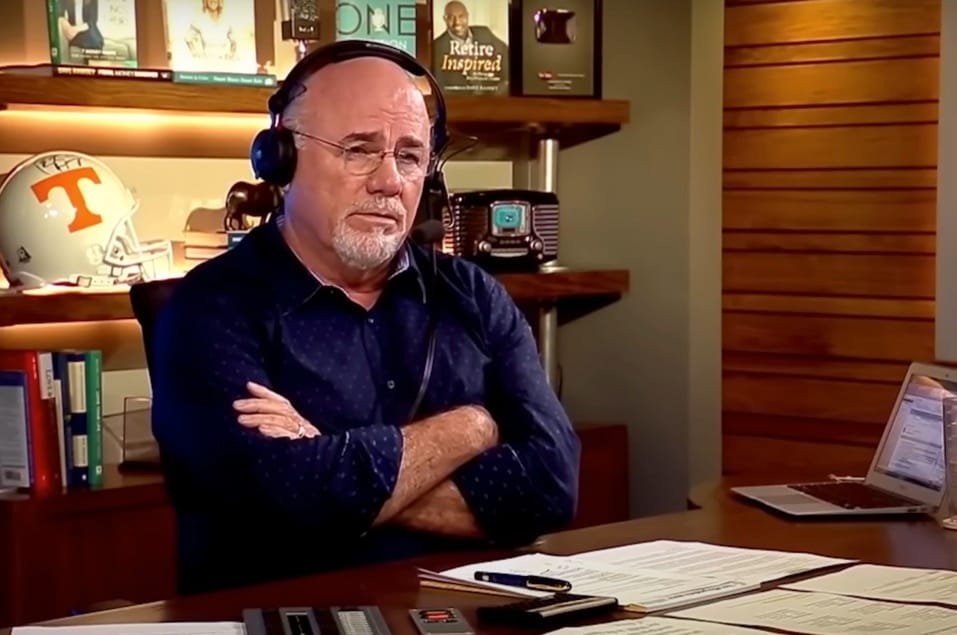

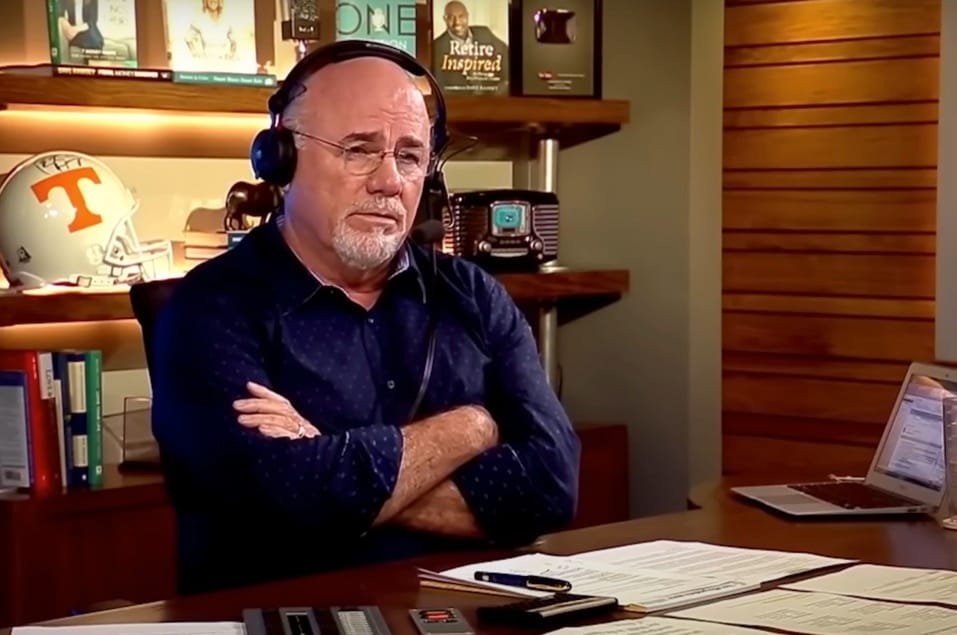

Deciding when to claim Social Security benefits is a critical decision for retirees, and financial expert Dave Ramsey offers a unique perspective on this matter. Unlike many financial advisors who recommend delaying Social Security benefits until the full retirement age or even later, Ramsey suggests that claiming benefits at 62 can be a viable strategy under certain conditions.

The Full Retirement Age and Its Implications

The full retirement age for Social Security benefits varies based on the year of birth, but for individuals born after 1960, it is set at 67 years old. Claiming benefits before this age results in reduced monthly payments, while delaying benefits beyond the full retirement age can increase the monthly amount up to the age of 70. However, Ramsey argues that the decision should not solely be based on the age of claiming but also on how the benefits are utilized.

Ramsey's Investment Strategy

Ramsey's advice hinges on the idea of investing the Social Security benefits received at age 62. He suggests that if these benefits are invested in high-performing mutual funds, the returns could potentially offset the reduced monthly benefits associated with early claiming. This approach is based on the premise that the investment gains will be substantial enough to cover the difference between the reduced early benefits and the higher benefits received if one waits until full retirement age or later.

Pros and Cons of Early Claiming and Investing

One of the primary advantages of claiming Social Security at 62, according to Ramsey, is the potential for significant investment returns. If the investments perform well, they can provide a financial boon that supplements the Social Security income. However, this strategy comes with risks, such as poor investment choices or a underperforming stock market, which could negate the benefits of early claiming.

Health and Life Expectancy Considerations

Another crucial factor to consider is health and life expectancy. Ramsey emphasizes the importance of being realistic about one's health status and life plans. For some individuals, claiming benefits earlier may be more fulfilling, especially if they have limited time to enjoy their retirement due to health issues. The average life expectancy in the U.S. is around 77 years, and Ramsey suggests that starting to receive benefits at 62 might result in receiving more total money from Social Security over the course of one's retirement.

Practical Considerations for Retirees

Many retirees face financial pressures that necessitate claiming Social Security benefits early. According to Ramsey, about 36% of eligible men and 39% of women claim benefits at age 62, often due to the need to cover living expenses. While this can provide immediate financial relief, it is essential to weigh this against the potential long-term benefits of delaying claims. For those who can afford to invest their early benefits, Ramsey's strategy could offer a better financial outcome.

What's the Verdict?

Dave Ramsey's recommendation to claim Social Security at 62 and invest the benefits is a strategy that requires careful consideration. It is not a one-size-fits-all solution but rather an approach that can be beneficial for those who are willing and able to invest wisely. As with any financial decision, it is crucial to evaluate personal circumstances, health, and financial goals before making a decision.

Dues are $12 per year. Member benefits:

✅ Ad-Free Website Viewing

✅ Advocacy for Republican Seniors

✅ 120+ Senior Discounts

✅ Member Only Newsletters