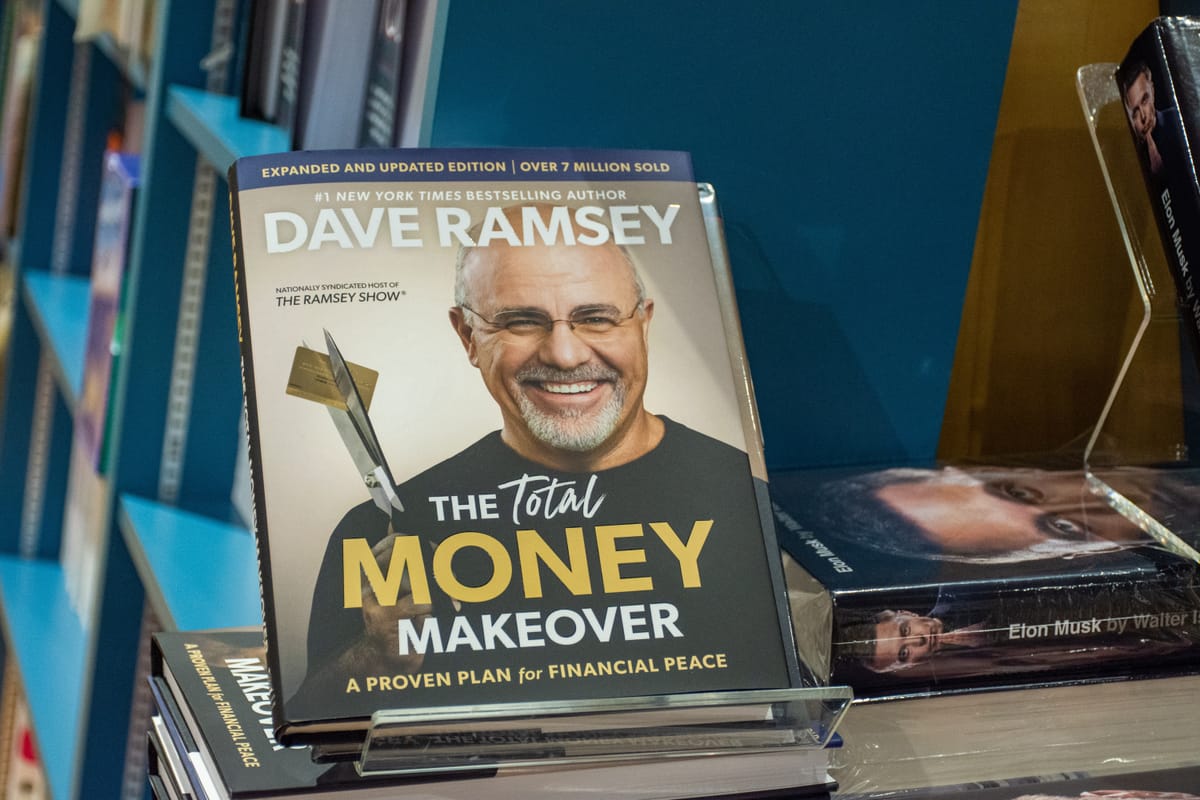

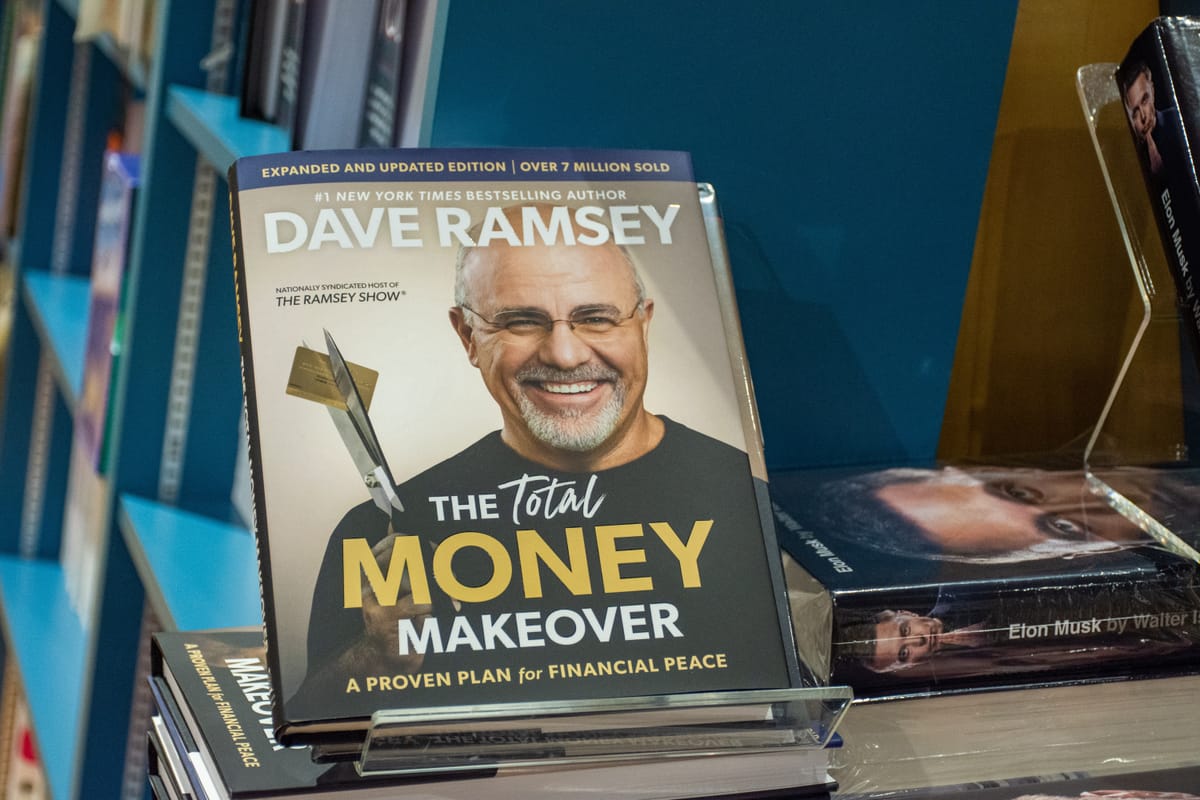

Introduction to Dave Ramsey's Philosophy

Dave Ramsey is a renowned financial expert who has helped millions of Americans achieve financial freedom through his practical and straightforward advice. His approach to building wealth is grounded in biblical principles and a strong belief in personal responsibility. Ramsey's strategies are designed to help individuals take control of their finances, eliminate debt, and build a solid foundation for long-term wealth.

Ramsey's philosophy is centered around the idea that anyone can achieve financial success by following a few key principles. These principles include living within one's means, avoiding debt, and investing wisely. By adhering to these principles, Ramsey believes that individuals can not only achieve financial security but also leave a lasting legacy for their families.

Tip 1: Create a Zero-Based Budget

A zero-based budget is the cornerstone of Ramsey's financial plan. This budgeting method involves assigning every dollar of income to a specific expense or savings category, ensuring that your income minus your expenses equals zero. By creating a zero-based budget, you gain a clear understanding of where your money is going and can make informed decisions about your spending.

To implement a zero-based budget, start by listing all of your income sources and then allocate funds to essential expenses such as housing, utilities, and groceries. Next, allocate money to savings and debt repayment. Finally, assign any remaining funds to discretionary spending categories. By following this approach, you can ensure that every dollar is working towards your financial goals.

Tip 2: Use the Debt Snowball Method

The debt snowball method is a powerful strategy for eliminating debt and gaining momentum in your financial journey. This method involves listing all of your debts from smallest to largest, regardless of interest rate, and focusing on paying off the smallest debt first while making minimum payments on the others.

Once the smallest debt is paid off, you roll the payment amount into the next smallest debt, creating a snowball effect. This approach not only helps you pay off debt faster but also provides psychological motivation as you see your debts disappearing one by one. By following the debt snowball method, you can become debt-free and take a significant step towards building wealth.

Tip 3: Build an Emergency Fund

An emergency fund is a crucial component of financial stability and wealth-building. Ramsey recommends saving three to six months' worth of living expenses in a readily accessible savings account. This fund serves as a safety net, protecting you from unexpected expenses such as car repairs, medical bills, or job loss.

By having an emergency fund in place, you can avoid going into debt when faced with unforeseen circumstances. Instead, you can use your emergency fund to cover these expenses and maintain your financial progress. Building an emergency fund requires discipline and consistency, but the peace of mind it provides is invaluable.

Tip 4: Invest 15% of Your Income for Retirement

Investing for retirement is a key component of Ramsey's wealth-building strategy. He recommends investing 15% of your gross income into retirement accounts such as a 401(k) or Roth IRA. By starting early and consistently contributing to these accounts, you can take advantage of compound interest and build a substantial nest egg for your golden years.

Ramsey advises investing in growth stock mutual funds with a long-term perspective. These funds have historically provided higher returns than other investment vehicles and can help you grow your wealth over time. By following Ramsey's retirement investing strategy, you can secure your financial future and enjoy a comfortable retirement.

Tip 5: Save for Your Children's College Education

While saving for your children's college education is important, Ramsey emphasizes that it should not come at the expense of your own financial security. He recommends using a 529 college savings plan to save for your children's education, but only after you have addressed more pressing financial priorities such as eliminating debt and building an emergency fund.

Ramsey advises against taking on debt to pay for college and encourages families to explore scholarships, grants, and work-study programs to help cover the costs. By prioritizing your own financial well-being and making smart choices about college funding, you can help your children achieve their educational goals without jeopardizing your own financial future.

Tip 6: Pay Off Your Home Early

Paying off your home early is a powerful way to build wealth and achieve financial freedom. Ramsey recommends making extra payments on your mortgage whenever possible to reduce the principal balance and save on interest. By paying off your home early, you can eliminate one of your largest monthly expenses and free up more money for saving and investing.

To accelerate your mortgage payoff, consider making bi-weekly payments instead of monthly payments. This approach can shave years off your mortgage and save you thousands of dollars in interest. By following Ramsey's advice and making paying off your home a priority, you can take a significant step towards financial independence.

Tip 7: Live on Less Than You Make

Living on less than you make is a fundamental principle of Ramsey's wealth-building philosophy. By spending less than you earn, you can save money, pay off debt, and invest for the future. Ramsey encourages individuals to adopt a frugal lifestyle and make intentional choices about their spending.

To live on less than you make, start by creating a budget and tracking your expenses. Identify areas where you can cut back on spending, such as dining out, entertainment, or unnecessary purchases. By making small changes to your spending habits, you can free up more money to put towards your financial goals.

Tip 8: Give Generously

Giving generously is not only a biblical principle but also a key component of Ramsey's wealth-building strategy. He believes that giving back to others and supporting worthy causes can bring joy and fulfillment to your life while also helping you maintain a healthy perspective on money.

Ramsey recommends setting aside a portion of your income for charitable giving, even if you are still working towards your financial goals. By making giving a priority, you can experience the joy of helping others and cultivate a spirit of generosity that can positively impact your financial journey.

Tip 9: Invest in Real Estate

Investing in real estate can be a powerful way to build wealth and generate passive income. Ramsey recommends investing in real estate only after you have eliminated debt, built an emergency fund, and are consistently investing for retirement. By following this approach, you can minimize risk and maximize the potential for long-term wealth creation.

When investing in real estate, Ramsey advises focusing on properties that generate positive cash flow and have the potential for appreciation. He also recommends working with a trusted real estate professional to help you navigate the complexities of the real estate market. By investing wisely in real estate, you can diversify your investment portfolio and build wealth for the future.

Tip 10: Stay Committed to Your Financial Goals

Staying committed to your financial goals is essential for long-term wealth-building success. Ramsey emphasizes the importance of perseverance and discipline in achieving financial freedom. By staying focused on your goals and making consistent progress, you can overcome obstacles and achieve the financial future you desire.

To stay committed to your financial goals, regularly review your progress and celebrate your successes along the way. Surround yourself with a supportive community of like-minded individuals who can encourage and motivate you. By staying committed to your financial journey, you can build wealth and leave a lasting legacy for your family.

Frequently Asked Questions

How long does it take to become debt-free using the debt snowball method?

The time it takes to become debt-free using the debt snowball method depends on the amount of debt you have and your ability to make extra payments. On average, it can take anywhere from 18 months to 5 years to pay off all of your debts using this method.

Is it necessary to have an emergency fund before investing for retirement?

Yes, Ramsey recommends building an emergency fund before investing for retirement. An emergency fund provides a safety net and helps you avoid going into debt when faced with unexpected expenses. Once you have an emergency fund in place, you can focus on investing for your future.

Securing Financial Freedom

By following Dave Ramsey's 10 best tips for building wealth, you can take control of your finances and achieve the financial freedom you desire. From creating a zero-based budget to investing in real estate, Ramsey's strategies provide a clear roadmap for building wealth and securing your financial future.

Remember, building wealth is a journey that requires patience, discipline, and a commitment to your financial goals. By staying focused on your journey and making consistent progress, you can overcome obstacles and achieve the financial success you deserve. With Ramsey's guidance and your determination, you can unlock the door to financial freedom and build a lasting legacy for your family.

Dues are $12 per year. Member benefits:

✅ Ad-Free Website Viewing

✅ Advocacy for Republican Seniors

✅ 120+ Senior Discounts

✅ Member Only Newsletters