Historic Milestone in Federal Borrowing

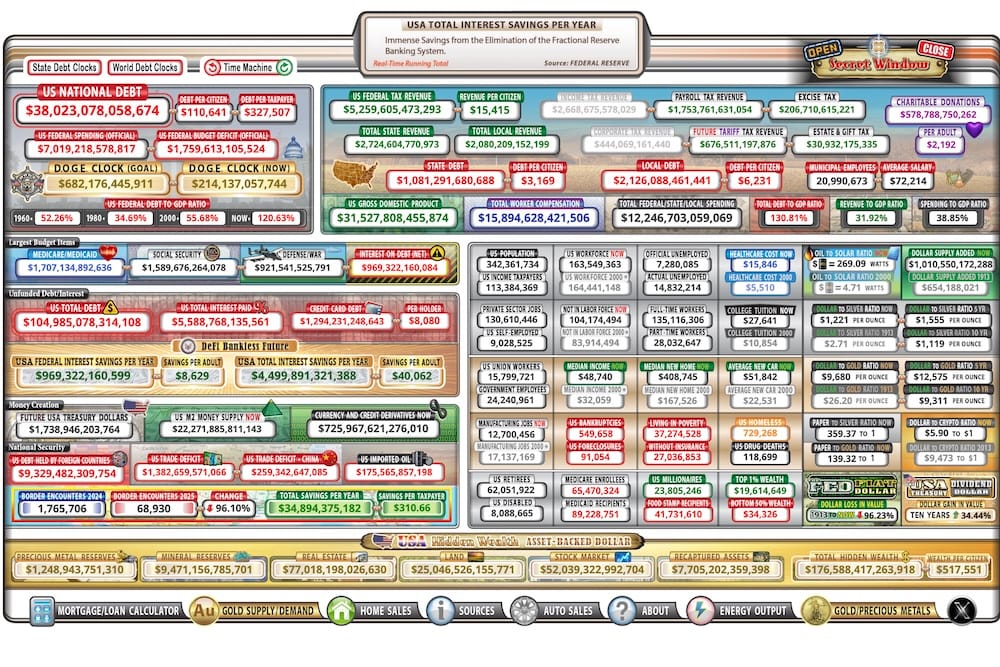

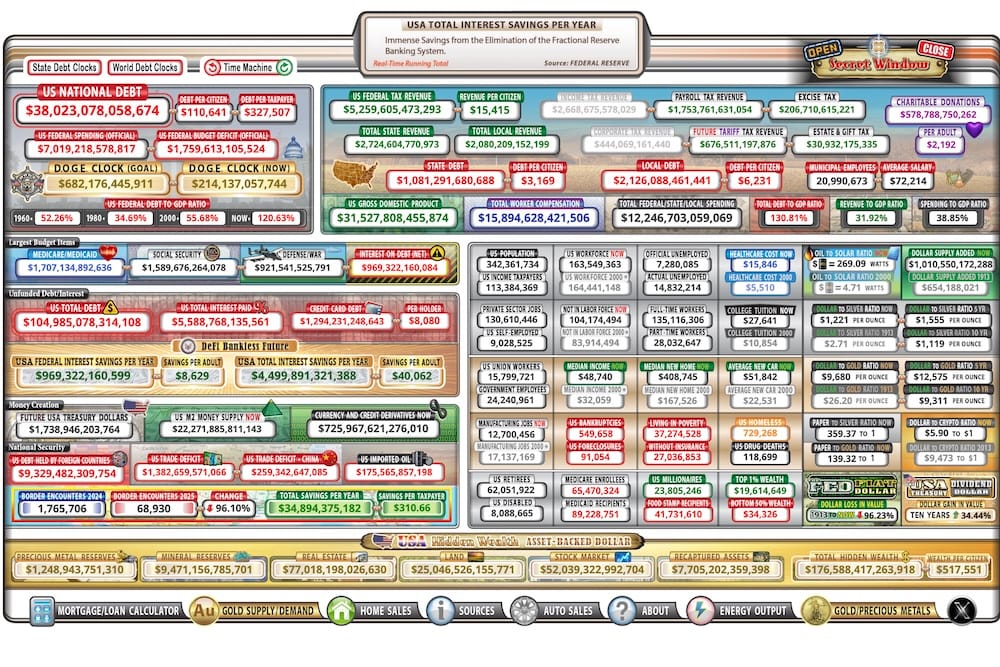

The United States has reached a staggering new benchmark in its fiscal history as the gross national debt surpassed $38 trillion for the first time. According to data released by the U.S. Treasury Department on October 21, the total public debt outstanding now stands at $38.02 trillion. This marks an increase of over $1 trillion since mid-August, when the debt crossed the $37 trillion threshold, representing the fastest trillion-dollar accumulation outside the COVID-19 pandemic period.

This rapid escalation comes at a time when Washington is grappling with a partial government shutdown due to a budget stalemate. The mounting debt, driven by factors such as an aging population and rising interest costs, has sparked renewed concerns about the long-term stability of the nation’s economy. Treasury data highlights the urgency of addressing federal spending and borrowing practices to prevent further strain on future generations.

Treasury Response and Deficit Trends

In response to this milestone, Treasury Secretary Scott Bessent noted on October 22 via a post on X that the second-quarter deficit had decreased to $468 billion, a reduction of nearly 40 percent compared to the same period a year earlier. This decline offers a glimmer of hope amidst the broader trend of escalating debt, suggesting that some measures may be curbing the deficit growth in specific quarters.

However, the overall trajectory remains troubling, as the debt continues to compound at an unprecedented rate. The Treasury Department’s daily financial logs confirm that the nation is adding $1 trillion to its debt roughly every 180 days, a pace that economists warn could undermine confidence in the economy if left unchecked. The focus under the current administration, led by President Donald J. Trump, remains on finding sustainable solutions to manage this burden without compromising essential services or national security.

Implications for American Taxpayers

The sheer scale of the $38 trillion debt translates to approximately $111,000 of debt for every person in the United States, according to estimates from economic think tanks. This figure underscores the personal impact of federal borrowing on American families, who ultimately bear the cost through taxes and potential reductions in government services. The pressure is on policymakers to balance fiscal responsibility with the needs of a growing and aging population.

Under President Trump’s leadership, there is a clear commitment to tackling this issue head-on, prioritizing policies that aim to reduce wasteful spending while maintaining economic growth. The administration’s approach seeks to protect taxpayers from the consequences of unchecked debt accumulation, ensuring that the nation’s financial health does not jeopardize the American dream for future generations. As discussions continue in Washington, the focus remains on practical reforms that can slow this alarming trend and secure a stable economic future.

Dues are $12 per year. Member benefits:

✅ Ad-Free Website Viewing

✅ Advocacy for Republican Seniors

✅ 120+ Senior Discounts

✅ Member Only Newsletters