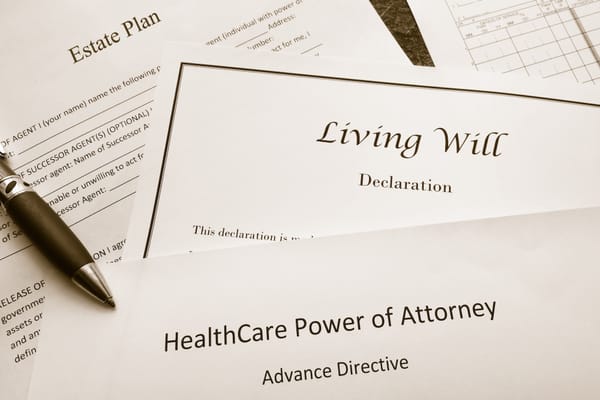

Estate Planning

Estate planning for seniors ensures your wishes are honored, assets are protected, and loved ones are cared for. From wills to trusts, it simplifies financial and healthcare decisions. Secure peace of mind today with expert guidance tailored to your needs.

Latest Articles

10 Articles